In light of recent developments in the banking sector, many people are understandably concerned about the safety of their cash balances. Particularly, of concern are large deposits beyond the Federal Deposit Insurance Corporation (FDIC) insurance limits. In this article, we’ll discuss what happened and a simple solution that can provide both high yields and FDIC insurance for deposits up to $2.5 million: AssetMark Trust’s High Yield Cash.

The recent bank failures of Silicon Valley Bank (SVB), Silvergate, and Signature Bank have understandably raised concerns about the safety of bank deposits. Customers who had deposits that were within the FDIC's coverage limits were protected by FDIC insurance. Silicon Valley Bank customers whose balances exceeded the FDIC's coverage limits were at risk of losing funds. The Federal Deposit Insurance Corporation (FDIC) decided to transfer all deposits—both insured and uninsured—and substantially all assets of the former Silicon Valley Bank of Santa Clara, California, to a newly created, full-service FDIC-operated ‘bridge bank’ in an action designed to protect all depositors of Silicon Valley Bank.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that provides insurance to depositors in case a bank fails. If a bank with FDIC insurance fails, depositors are protected up to $250,000 per depositor, per account ownership category, per insured bank.

The FDIC states, “The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.”

The FDIC responds in two capacities.

First, as the insurer of the bank’s deposits, the FDIC pays insurance to depositors up to the insurance limit. Historically, the FDIC pays insurance within a few days after a bank closing, usually the next business day, by either providing each depositor with a new account at another insured bank in an amount equal to the insured balance of their account at the failed bank or issuing a check to each depositor for the insured balance of their account at the failed bank.

Second, as the receiver of the failed bank, the FDIC assumes the task of selling/collecting the assets of the failed bank and settling its debts, including claims for deposits in excess of the insured limit. If a depositor has uninsured funds (i.e., funds above the insured limit), they may recover some portion of their uninsured funds from the proceeds from the sale of failed bank assets. However, it can take several years to sell off the assets of a failed bank. As assets are sold, depositors who had uninsured funds usually receive periodic payments (on a pro-rata “cents on the dollar” basis) on their remaining claim.

Balances over $250,000 in a single account ownership category at a bank may not be fully insured by the FDIC. The FDIC has a tool called EDIE (Electronic Deposit Insurance Estimator) that can help determine coverage.

There are ways to increase coverage. One option is to open multiple accounts of different ownership categories at different FDIC-insured banks. The other option is to open a single High Yield Cash account with AssetMark Trust.

High yield savings accounts are deposit accounts offered by some banks that offer higher interest rates than traditional savings accounts. These bank accounts typically require a minimum balance to open and maintain, but they also offer more competitive interest rates than standard bank savings accounts.

What is the downside of a high yield savings account? Variable interest rates, which can fluctuate based on market conditions. FDIC insurance coverage is limited to $250,000 per ownership category.

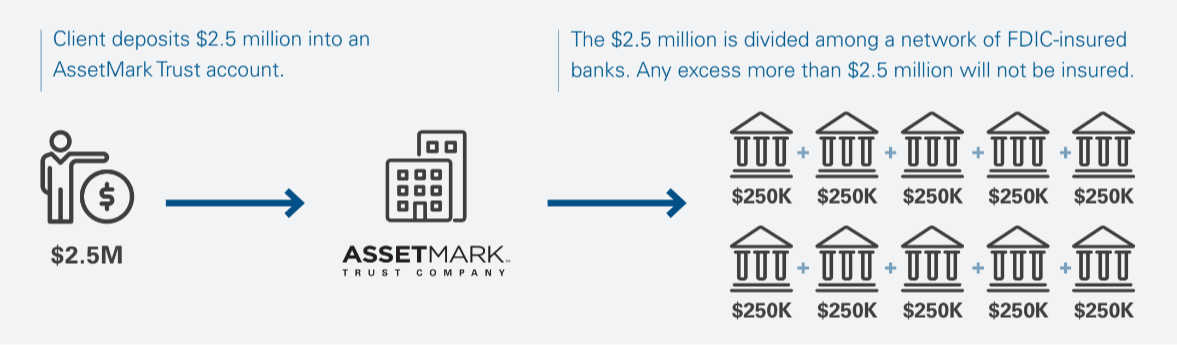

High Yield Cash is an AssetMark Trust program that enables investors to open one custodial account and have the money placed in a network of different banks designed to extend FDIC insurance up to $2.5 million dollars.

What is the downside of a High Yield Cash account? Variable interest rates, which can fluctuate based on market conditions. FDIC insurance coverage is limited to $2,500,000 per ownership category.

Clients with less than $250,000 in deposits may find high yield savings accounts, offered by FDIC insured banks, meets their needs.

Clients with more than $250,000 in deposits may find the High Yield Cash, an AssetMark Trust cash sweep account with extended FDIC insurance, helps meet their needs.

Competitive interest rates: High Yield Cash offers competitive short-term interest rates.

FDIC insurance: Balances in High Yield Cash accounts are insured by the FDIC up to $2,500,000 per account ownership category, per depositor. This means that if the bank fails, your deposits are insured by the FDIC, providing protection for your cash balances.

These are the three most common uses:

The FDIC-insured banks in the Cash Program are selected based on stringent criteria including their overall financial health and stability. AssetMark Trust closely monitors the health and stability of program banks. We take three primary approaches to safeguarding cash:

Does the High Yield Cash program have exposure to any banks recently seized by the FDIC? No. Silicon Valley Bank (SVB), Signature Bank, and Silvergate Bank are not part of the program.

How can investors see a list of banks in the program? You may visit this page on AssetMark’s website for a list of program banks with whom AssetMark Trust currently works.

Can investors opt out of depositing their cash in any of the High Yield Cash program banks? Yes, you have the option to opt your client’s cash out from being deposited in a specific bank. Please contact your AssetMark Representative for more information.

In conclusion, High Yield Cash and high-yield savings bank accounts can provide competitive interest rates while still protecting balances with FDIC insurance. Consider financial goals and needs or talk with an AssetMark Consultant.

1 While we believe these measures significantly reduce program risk, predicting risk factors in bank stress environments is challenging, and there are no guarantees that our criteria will be successful in all instances.

Important Information

AssetMark Trust Company is an Arizona trust company and an affiliate of AssetMark, Inc., AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Subscribe to get a monthly recap of AssetMark blog articles.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses. The information on this website is for informational purposes only and is intended as an overview of the services offered to financial advisors, not a solicitation for investment. Information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change.

Advisors seeking more information about AssetMark’s services should contact us; individual investors should consult with their financial advisor.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Visit our ownership page for more information.

© 2025 Copyright AssetMark, Inc. All rights reserved. 6916884.1 | 02/2025