As December 31 approaches, many people turn their thoughts to charitable giving. Whether the impetus is related to spending down an anticipated year-end bonus, maximizing tax incentives, honoring a loved one for the holidays, or part of an overall giving plan, this time of year can be one where giving is top of mind.

However, for high-net-worth (HNW) and ultra-high-net-worth (UHNW) donors, philanthropy is often more complex than writing a check once a year. These individuals and family members generally have a broader menu of giving options to choose from to make a greater impact.

Charitable giving is simply donating time, money, or possessions without expecting any personal gains in return.

Some examples of charitable giving include volunteering time and expertise to special causes, making financial contributions to nonprofit organizations, community foundations, or private family foundations, and transferring in-kind stocks, bonds, mutual funds, and other securities to nonprofits.

Charitable giving for HNW/UHNW clients can involve more advanced strategies like donor-advised funds, charitable lead annuity trusts, and private foundations—and is considered to be an important part of a wealth management plan.

A recent study of HNW investors showed that nine out of ten agreed that a charitable giving strategy should be part of an overall wealth strategy. Today’s HNW philanthropists recognize the importance of giving back, both individually and as family units, with eight out of ten HNW Generation X and three-quarters of HNW Millennial investors already having a charitable giving strategy.

So, who is considered HNW or UHNW? Although the definitions vary, for the most part, individuals who have more than $5 million in liquid assets are considered high-net-worth, while individuals with more than $30 million in investable assets are considered ultra-high-net-worth.

The recent pandemic and ongoing local and global challenges continue to shine a spotlight on the importance of charitable giving and the impact it can have, big and small.

According to a report, HNW investors are giving more in the post-pandemic era than they did before the pandemic. In fact, a study found that over 85% of affluent households maintained or increased their giving despite uncertainty about COVID-19 and its economic impact.

The research seems to indicate that in times of economic uncertainty, people are stepping up to help more. Others may contest that tax benefits are a primary motivation for the uptick in giving.

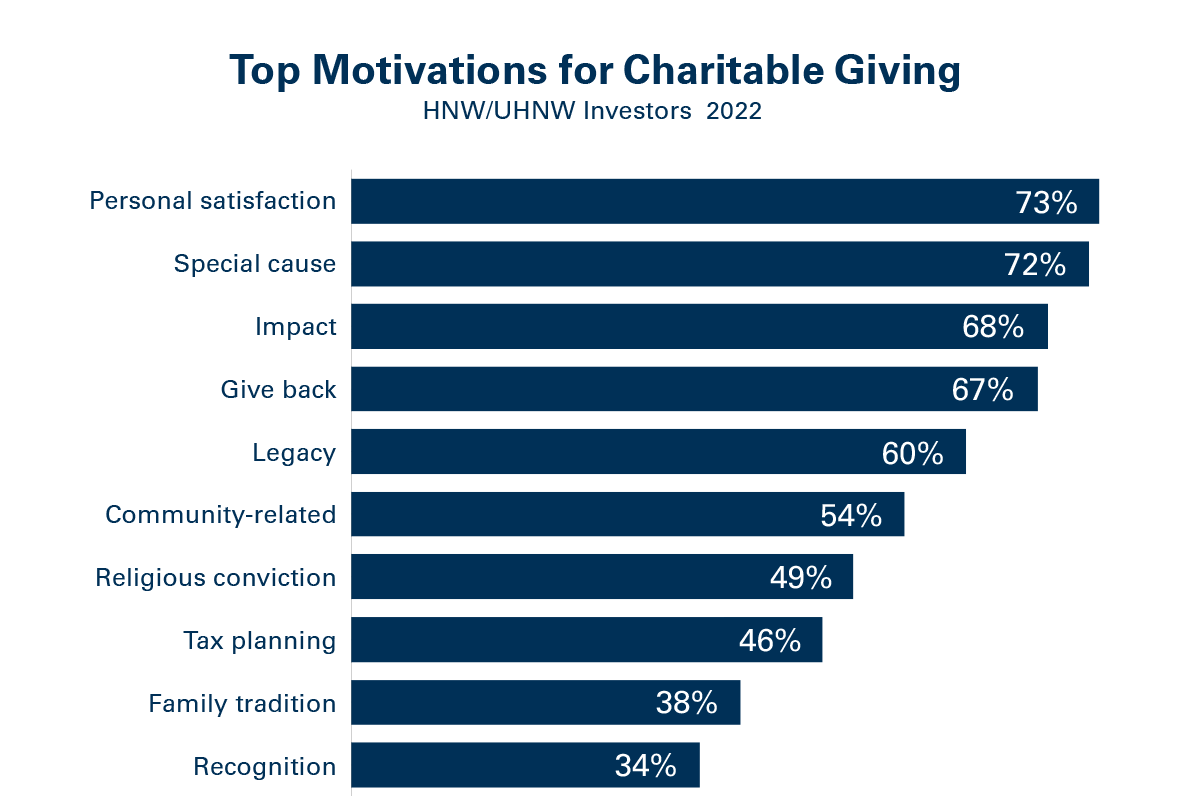

However, a study from BNY Wealth Management on charitable giving asked HNW/UHNW investors to rank the reasons they donate (results shown below). Tax planning comes in eight out of the ten options, while personal recognition ranks last. The top reasons are personal satisfaction and an emotional connection to a special cause or organization.

Source: BNY Mellon Wealth Management Charitable Giving Study

Another interesting finding in the study is that for the wealthy, charity is often a family affair, with close to half of investors working with their families to put forth a strategy, and 88% working with their spouse or partner. These findings shine an important light on the importance HNW and UHNW investors place on their charitable giving strategy in their lives and in their community.

Often HNW/UHNW philanthropists have more advanced mechanisms to execute their charitable giving than their mass affluent counterparts. While taxes tend to NOT be the primary motivator for charitable giving in the HNW arena, achieving tax benefits, while also maximizing the impact of their gifts, is a win-win for all.

Private Foundations are charitable organizations that can be established by individuals, families, or companies. Most of the funding comes from the founders, and typically a board of directors manages the strategy and allocation of funds.

These independent charitable entities funded by philanthropic families or individuals make annual grants to one or more public charities of their choice. There are income tax and estate tax planning benefits:

The foundation controls its assets and grant-making process and must distribute at least 5% of the value of its assets (as determined annually).

Donor Advised Funds are charitable giving funds that individuals, families, or organizations can contribute to and are managed on their behalf by a charitable sponsoring organization. So, while donors can advise on the investment of assets and the distribution of funds (thus the name) in their own account, they do not bear the burden of managing the fund.

In 2021, the number of Donor Advised Funds, or DAFs, climbed above one million for the first time. It’s easy to see why: this flexible charitable entity gives funders a tax deduction (up to 60% of AGI for cash donations) immediately—even if an actual donation doesn’t occur in the same year. Assets within the DAF grow tax free; the donor can contribute to the DAF as often as they like and make recommendations for grants from the fund. And the entity can be funded with securities instead of cash if desired. It’s important to note that contributions to a DAF are irrevocable.

There are two main types of Charitable Trusts: Charitable Lead Trusts and Charitable Remainder Trusts. Both are irrevocable and essentially mirror each other:

Looking to save on capital gains and income taxes while also potentially increasing the value of your donation? Here’s a tactic that benefits donors and their charities: donate shares of stock.

Extended giving involves “bunching” multiple years of gifts into one deduction that is taken at one time for donations that may be spread over time. A donor-advised fund is a great vehicle for this because you receive “credit” for the donation immediately but have the flexibility to spread donations out over time.

Tax-loss harvesting is the sale of underperforming stocks to reduce taxable capital gains. Given recent market volatility, selling securities that are worth less than the cost basis to offset capital gains and up to $3,000 of ordinary income is a timely strategy. If the proceeds from the sale are donated, the amount is considered a charitable deduction.

A QCD allows the charitably minded over 70½ years of age to make a tax-free gift of up to $100,000 each year directly from their IRA to qualifying charities, thereby possibly reducing taxable income. Note that QCD donations are not considered charitable deductions.

People with greater wealth account for a significant share of charitable contributions. Excluding gifts from estates or foundations, in 2018, people in the top income quintile were responsible for 63 percent of all charitable contributions (an estimated $193 billion out of a projected $306 billion).

And, as the great wealth transfer continues, it’s more important than ever to work with HNW families to ensure the generations that follow will maintain a legacy of family philanthropy. Involve the younger generations in the conversation to discuss the values and causes they support.

Charitable giving should be a regular part of overall financial planning and not just something to think about near year-end. Strategic philanthropy management can lead to a greater impact for recipients and better tax-related benefits. Tax laws are complex, and any charitable gifting or charitable giving tax strategies should be discussed with a tax professional.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Subscribe to get a monthly recap of AssetMark blog articles.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses. The information on this website is for informational purposes only and is intended as an overview of the services offered to financial advisors, not a solicitation for investment. Information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change.

Advisors seeking more information about AssetMark’s services should contact us; individual investors should consult with their financial advisor.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Visit our ownership page for more information.

© 2025 Copyright AssetMark, Inc. All rights reserved. 6916884.1 | 02/2025