AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Though faith-based investing isn’t a new concept, many investors aren’t aware that they can align their investments with their religious values. For investors, designing an investment strategy that aligns with the principles and teachings of their religion and promotes positive change presents an enticing opportunity.

This article explains what faith-based investing is, the different approaches investors can take, and how you and your clients can build portfolios for potential profit and purpose.

Top Takeaways:

First and foremost, it is important to remember that faith-based investing is not wholly different than traditional secular investing. The objective is to invest with purpose and deliver compelling returns at a desirable level of risk which directly tie to investor goals. Faith-based investing differs only in the manner in which those investor goals are pursued; namely, it views global markets through a lens that opts for investments that align with the values and teachings of faith—namely the sanctity of life, family, stewardship, health, and safety.

While distinct, faith-based investing is part of a broader umbrella of values-based investing, which includes, but is not limited to, socially responsible investing (SRI), environmental, social, and governance (ESG) investing, and impact investing. SRI investments typically avoid the stocks of companies involved in activities that are believed to be negative for society, such as gambling, alcohol, tobacco, pornography, or gun manufacturing. ESG, meanwhile, uses screens around factors like climate change, labor practices, and corporate management, to understand the risks that companies might face. For example, a company that pollutes could face regulatory fines and civil lawsuits—a potential risk for investors.

All these approaches believe that investors can reap the financial gain of participating in the capital markets, minimizing involvement risk and without sacrificing their values.

In one form or another, American Christians have practiced the principles of faith-based investing for hundreds of years.

Before the Civil War, Quakers in the United States started the Free Produce movement to boycott products made from slave labor, including cotton cloth and sugar cane.

In the 1970s and 1980s, Roman Catholics expressed their Christian values by avoiding the stocks of companies doing business with the South African apartheid regime. Many observers credit this divestment movement for ending apartheid.

Around the same time, a group of retired Catholic nuns took a much more hands-on approach to faith-based investing. They used their pooled investments to buy the minimum number of shares needed in order to pressure corporations to adopt better labor and environmental practices by filing shareholder resolutions for actions they wanted to see.

As you can see, there are some overlaps in the investment priorities of different religious groups, but there are also important distinctions. Faith-based investing is a big umbrella and allows different religious communities to find ways to invest in companies that align with their religious beliefs.

Although faith-based investing is often associated with Christian values, it isn’t limited to Christian investors. Because every religion has a set of values and beliefs about what kind of activities should be promoted and which should be avoided, faith-based investing gives these investors an opportunity to put those beliefs into action.

For example, Muslim investors may seek to avoid companies involved in money lending with interest and the sale or production of pork or alcohol, all of which are prohibited by Islamic law, or shari’a. In order to participate in the capital markets, Islamic finance has evolved to create special financial instruments, known as sukuk, that do not violate the religion’s prohibition on usury.

In Judaism, the prohibitions on certain economic activities are less explicit, but many Jewish investors choose to express their religious values through more general, socially responsible investing strategies. Investments that address climate change, social justice, and good governance adhere closely to Judaism’s commandments to perform mitzvot, or good deeds.

While individuals may have a personal interest in faith-based investing, institutions can also participate. For instance, a church may have an endowment, but it doesn’t want to financially support activities that go against church teachings.

Because there isn’t one definition of faith-based investing, it’s hard to say what the performance record of this investment category is. However, research has looked at the returns of different types of values-based investing.

An increasing number of studies demonstrate that performance results broadly skew towards neutral to positive outcomes for socially responsible investments compared to those of traditional investments. In a meta-analysis of research studies, researchers concluded that corporations that undertake sustainability initiatives have better financial performance because they have better risk management controls.

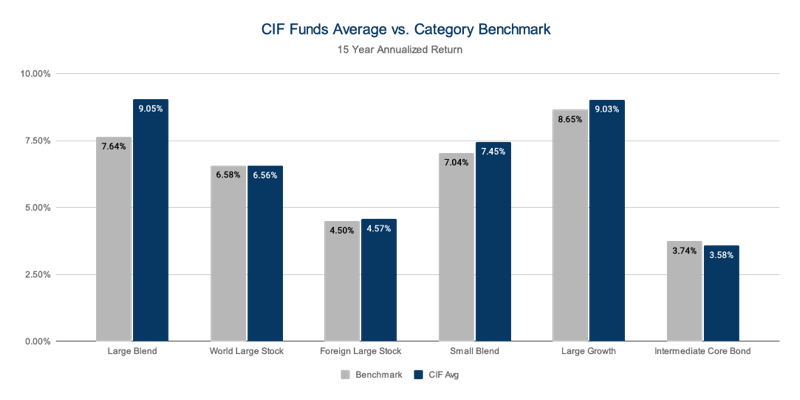

A 2020 analysis by the Christian Investment Forum looked at the returns of 44 Christian faith-based equity and bond funds and found that the average return outperformed the benchmarks in their categories. The results were consistent over one-, three-, five-, 10-, and 15-year time periods.

Source: Christian Investment Forum

Just as there are many ways to express faith, there are many ways to practice faith-based investing, from investing in individual stocks to using mutual funds and exchange-traded funds. For investors today, the hardest part in implementing a faith-based strategy isn’t in finding investment vehicles but in defining what faith-based investing means for themselves.

Faith-based investors can employ a number of approaches when selecting investments:

Investors—as well as mutual funds and exchange-traded funds—can use one of these approaches or a combination of approaches in their overall investment strategy.

Because faith-based investing is so personal, financial advisors must work with each of their clients to understand the issues and values that are most important to them. These two steps will help you structure a faith-based investing strategy that gets at the heart of what matters most to your clients.

Start by asking your clients, “What issues matter most to you?” or “Which activities do you want to avoid?” Not every client who wants to practice faith-based investing will do it in the same way. Some may wish to adhere strictly to the teachings of their religion. Others may take a more lax approach.

Decide the best way that faith-based investments will fit into your clients’ portfolios to meet their financial goals. There are several options to choose from when providing investment advice:

With many available options, it’s never been easier for faith-based investors to make a positive impact with their money. Whether they’re an individual, family, religious institution, or socially responsible organization, faith-based investors can have both profit and purpose.

Want to know more? Reach out to your asset management consultant.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Subscribe to get a monthly recap of AssetMark blog articles.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses. The information on this website is for informational purposes only and is intended as an overview of the services offered to financial advisors, not a solicitation for investment. Information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change.

Advisors seeking more information about AssetMark’s services should contact us; individual investors should consult with their financial advisor.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Visit our ownership page for more information.

© 2026 Copyright AssetMark, Inc. All rights reserved. 6916884.1 | 02/2025