Have you ever heard someone say, “There’s many a slip between cup and lip?” Even if you haven’t, you’ll likely recognize the truth behind it. This old maxim highlights how life has a way of stealing expected outcomes, which is certainly true in the financial services arena where competition for client assets has never been fiercer.

By way of example, let’s say you have a long-time client who experiences a liquidity event—the sale of a business, inheritance, etc.—and they want you to invest the bulk of their windfall for them. Congratulations!

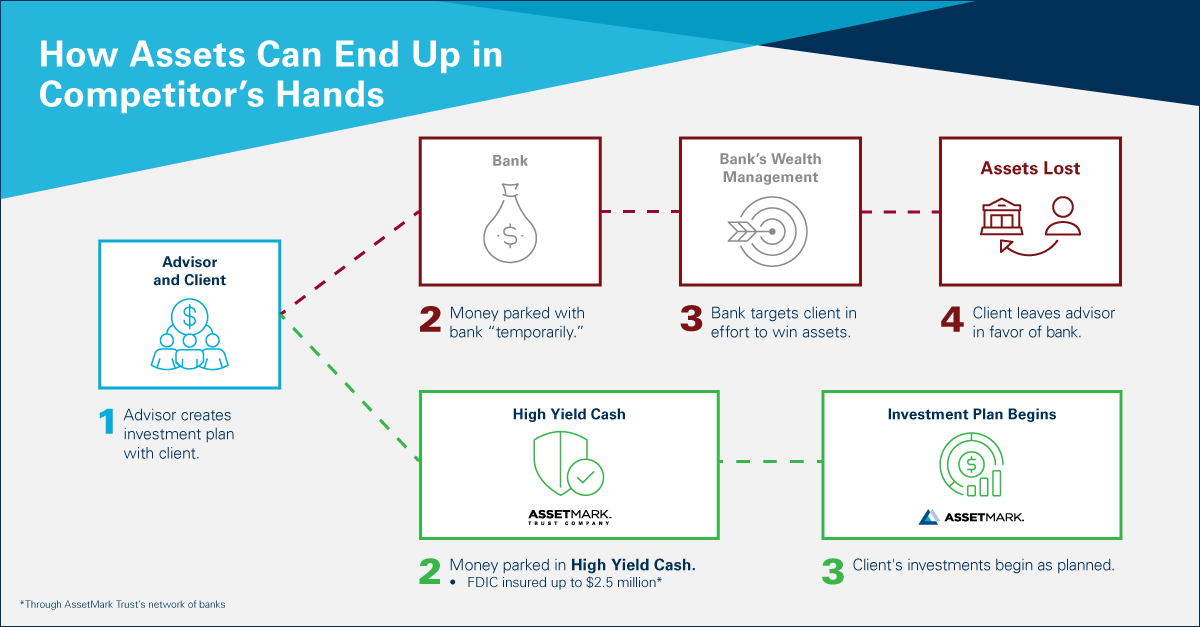

Before you get those assets transferred and the new account funded, however, a mega-competitor gets between you and your client, and those client assets end up in a brokerage or private bank associated with that mega-competitor. What happened?

Bankers are on alert for large pools of cash. Between realizing the gains from a liquidity event and investing them, those assets typically need to be “parked” for a short period of time prior to account establishment and investment. It’s not uncommon for a client or even an advisor to park them with a large national bank.

Most large national banks are affiliated with a brokerage firm and offer a wide variety of services that are often in direct competition with the independent advisors and RIAs with whom a client wants to invest.

When bankers recognize a large inflow or balance in a client’s checking or savings account, their account management efforts immediately begin processes to retain those assets for their institutions.

Given that, simply depositing funds in a pre-existing account or opening a transition account with another institution will very likely expose those assets to unnecessary competition.

In recognition of this pitfall, AssetMark Trust developed the AssetMark Trust’s High Yield Cash (HYC) program to give advisors and their clients a smooth transition when parking assets for the short term.

High Yield Cash is an FDIC-insured enhanced solution for large cash balances, with FDIC insurance extended to up to $2.5 million and higher deposit rates offered at $100,000, $250,000, $1 million, and $10 million.

Competing against other independent advisors and RIAs is difficult enough; competing with the biggest financial services firms in the country is a challenge best avoided. So, how can an advisor minimize the potential of a competitor coming between them and their client (technically referred to as intermediation)?

By leveraging the HYC program, advisors are able to:

Designing a transition plan for portfolios that is simple and seamless helps support your firm’s customer success efforts and, ultimately, client retention.

While advisors find High Yield Cash simple and efficient, HYC appeals to clients for financial and practical reasons as well:

If you have additional assets in your pipeline that you want to protect from intermediation or just want to be prepared for future opportunities, AssetMark Trust has you covered.

Talk with your AssetMark Consultant or visit the AssetMark Trust’s Complete Cash Solutions page to learn more.

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. More information can be found at www.fdic.gov/deposit/deposits/

See the AssetMark Trust Company FDIC-Insured Cash Program Disclosure Statement and AssetMark Trust Company Custody Agreement for details and restrictions.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Subscribe to get a monthly recap of AssetMark blog articles.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses. The information on this website is for informational purposes only and is intended as an overview of the services offered to financial advisors, not a solicitation for investment. Information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change.

Advisors seeking more information about AssetMark’s services should contact us; individual investors should consult with their financial advisor.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Visit our ownership page for more information.

© 2025 Copyright AssetMark, Inc. All rights reserved. 6916884.1 | 02/2025