AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

“Doing good while doing well,” is a fun bit of wordplay, and for the 85% of investors interested in sustainable investing, it’s an increasingly important underpinning of their financial planning efforts. But does “making an impact” negatively impact an investor’s bottom line?

Socially responsible investing (SRI) is based on the analysis of companies’ social policies and their potential to generate financial returns. Decisions are then made to either invest or divest depending on whether the company aligns with the investor’s values. Examples of social factors vary and may range from the health effects of products (tobacco) to internal compensation models (gender wage gap).

Socially responsible investing is a subset of responsible investing, which is a subset of values-driven investing in its broadest sense. While distinct approaches, there are considerable overlaps between the various values-driven approaches, which has led to many terms being used interchangeably, such as sustainable, socially conscious, ethical, or impact investing, and where appropriate, the sharing of research study results, as well. Throughout this piece, the more commonly used terms “ESG” and “SRI” will be utilized to reference these approaches.

While often grouped together as one, there are subtle differences between the various approaches—socially responsible, environmental, social, and governance (ESG), and impact investing:

Socially responsible investing can trace its origins to religious interests. The practice is thought to have originated in the 1700s with both the Quakers and the Methodists. And, while the idea continued to be primarily associated with religious groups for many years, SRI has gone mainstream. At the start of 2020, about one-third of dollars under professional management in the U.S.–around $17.1 trillion–employed a sustainable investing strategy, a 42% increase.

Since 2018, U.S. sustainable-investing-fund inflows accelerated in the fourth quarter of 2020, as investors allocated $20.5 billion, more than doubling the previous record for a quarter. One estimate holds that ESG assets could reach $30 trillion by 2030, while others put the estimates even higher.

Among the many collateral consequences of recent–and some would say ongoing–social unrest in the U.S., the COVID-19 global pandemic, and the uptick in natural disasters attributable to climate change, was a realignment of priorities for corporations, their employees, and their investors. This shift has put an increased focus on sustainable investing and corporate governance in many areas, including social justice, global health, and climate change.

While there is variety in the values we champion as individuals, there are also some commonalities in the concerns that emerge over time.

For example, abstaining from investing in addictive substances or activities such as alcohol, gambling, or tobacco—perhaps individually because of the loss of a loved one, a personal struggle, or a medical or ethical conviction—as a whole, continues to be a thorn in the side of these industries. Here are some of the popular concerns today.

In the forefront even prior to the pandemic, thanks in large part to work by the Gates Foundation and other high-profile non-profits, global inequality regarding the quality of, and access to, healthcare resonates with today’s investors. The COVID outbreak put a spotlight on just how vulnerable, and interconnected, the global community is; and how access to effective healthcare benefits us all.

In a recent survey, 88% of global respondents ranked the environment as the priority most in focus among ESG factors. Here in the U.S., a recent government report warned, “Climate change is an emerging threat to the financial stability of the United States.” Aligning with these data points, a recent study indicated that 88% of Millennials were interested in climate-related investments.

The social factors that are expected to continue their recent popularity—particularly in light of the current market downturn and talks around a possible recession—are the internal company compensation models that affect many households, namely equal pay for women and executive compensation. It remains to be seen how changes in the economy will affect corporate decisions around human capital development, layoff policies, and living wages.

Like anything in life, socially responsible investing is not without challenges. Confluence Philanthropy recently hosted a panel that explored the obstacles:

Now for the big question: Does values-based investing compromise returns? No, the selection of companies for SRI investing first looks at social responsibility and then analyzes financial responsibility. For ESG models, ESG considerations help reduce risk and identify alpha opportunity that are expected to lead to better long-term risk-adjusted returns.

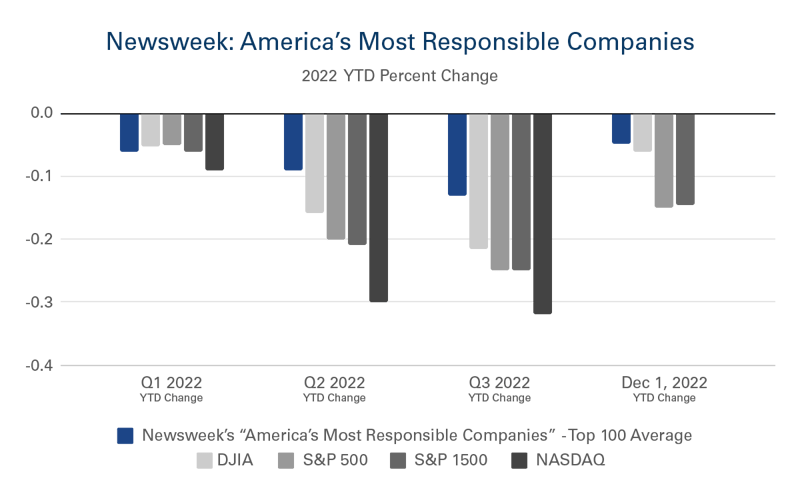

While 2022 has proven to be a harsh one for investments of all sorts, including those focused on socially responsible investing, a quick look at the top 100 publicly traded companies in Newsweek’s list of America's Most Responsible Companies 2022 reveals a (perhaps) surprisingly lower average percent loss than the large indices over the same timeframes in 2022.

Before you run to buy stocks from Newsweek’s list of responsible companies, we have to remind you that past performance is not indicative of future results.

Over the last three years, assets in global ESG equity products nearly doubled (+98%) from 2019 to 2021, with nearly 80% of global ESG equity products outperforming over the three-year period but underperforming in the first half of 2022, according to a recent InvestmentMetrics study.

In fact, a company featuring a strong ESG focus may actually add value to its bottom line and make itself a more attractive business partner. In a recent study, 56% of private equity partners said they have either refused to enter general partner agreements or turned down investments on ESG grounds.

Proponents of socially responsible investing often point to large corporate controversies—oil spills, labor controversies, compliance failures, or ethics violations—that resulted in irreparable brand damage. But are those isolated incidents, or does an ESG approach reduce risk?

A comparison of the MSCI ACWI Index and the MSCI ACWI ESG Universal Index shows that returns and risk are rather similar for both indices. With ten-year returns at 8.41% for the ESG index and 7.98% for the ACWI index and the ten-year Sharpe Ratio at 0.59 for the ESG index and 0.56 for the ACWI index, the ESG index does fare slightly better—though very slightly.

Additionally, an extensive study conducted by Morgan Stanley of 10,723 exchange-traded and open-ended mutual funds active in any given year from 2004-2018 found that sustainable funds may offer lower market risk. Sustainable funds consistently posted a 20% smaller downside deviation than traditional funds during the time studied.

Leveraging the expertise of an experienced financial advisor is imperative when considering sustainable investing. An advisor can help clarify your risk tolerance and investment approach while also offering insights into investment trends, risks, and benefits of integrating sustainable investment into a portfolio. A financial professional also offers greater awareness of the investment options available and familiarity with the managers at the helm.

Investors put great value on the expertise provided by financial professionals. The numbers generated by a recent survey speak to the interest investors have in socially responsible investing and the importance they place upon working alongside a financial advisor when it comes to SRI:

Aligning investments with values is a trend that’s not going away. How can you approach incorporating SRI into a portfolio? Begin by asking yourself what you value. And that will differ from person to person. It can run the gamut from animal welfare to clean water and from eradicating poverty to human rights, and more. Everyone has a cause – or causes – that resonate with them. Finding your “why” is the easy part of socially responsible investing.

And SRI is more than just an opportunity to improve society at large, it can also do wonders for your own little corner of the world. Responsible investing is often a bridge to engage family members. Bringing the next generation into the investment process builds financial literacy and gives them a seat at the table when it comes to putting family wealth to work.

It’s an opportunity to deepen relationships, promote inter-generational communication, and strengthen familial bonds. Discuss which areas of interest resonate with your children or grandchildren and be sure to include all the stakeholders in your conversations with your financial advisor.

Success comes in many forms. Socially responsible investing is a concrete, increasingly dynamic, example of that. Data has shown SRI can offer competitive, and sometimes superior returns and downside protection. So, not only can socially responsible investing be financially responsible, “success” can be found on many levels beyond percentage returns.

As entities, money managers, and corporations become more mindful of the impact they have on the world, investors do as well. So, it’s important to get it right.

Ensuring your clients invest in the solutions where they can do the most good can be challenging. Identifying the vehicles best designed to meet your clients' needs takes time and expertise. That’s why AssetMark supports financial advisors with the due diligence, investment management resources, and technology needed to conduct research, actively monitor client holdings, and provide ongoing portfolio updates.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses.

Subscribe to get a monthly recap of AssetMark blog articles.

AssetMark is a leading provider of extensive wealth management and technology solutions that help financial advisors meet the ever-changing needs of their clients and businesses. The information on this website is for informational purposes only and is intended as an overview of the services offered to financial advisors, not a solicitation for investment. Information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change.

Advisors seeking more information about AssetMark’s services should contact us; individual investors should consult with their financial advisor.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Visit our ownership page for more information.

© 2026 Copyright AssetMark, Inc. All rights reserved. 6916884.1 | 02/2025